Best Free Stock Trading Apps for September 2024

If investors plan to automate more of their investment process, they need to ensure their software is bug free. Traders look to enter new long positions on an upside breakout of a bullish rectangle, or initiate new short trades on a bearish rectangle downside breakout. Establish your strategy before you start. This happens when the price of the stocks which are mostly traded on the NYSE and NASDAQ markets either get ahead or behind the SandP Futures which are traded in the CME market. The pattern consists of 3 price swings. If you’re an advanced crypto trader, you may want to make sure your preferred exchange offers the trading types—like limit orders, which can prevent slippage by setting a hard price—and margin you want. WhatsApp: Click here to chat to us on our official WhatsApp channel, 10am to 7pm UTC+10, Monday to Friday. A crypto exchange is an online platform where traders and investors can purchase, sell or store cryptocurrency. 743 independent reviews. All of this information will be very useful when you finally sit down to review what you have done and will help you see if there is any way of improving your future strategies. What can make swing trading successful for newbie traders are some tips. Live prices on popular markets. The dollar strengthens against the euro, and EUR/USD is trading at 1. Several developments in the 70s and 80s helped quant become more mainstream. The green arrow indicates a point in time when the algorithm would’ve bought shares, and the red arrow indicates a point in time when this algorithm would’ve sold shares. If you put up $1,000 and decide to open a leveraged position that is trading 10:1, you can borrow $9,000 from the broker, which means your exposure in the market would be $10,000. Stock trading apps empower investors to buy and sell securities directly from the convenience of their mobile devices. Going long means that you are predicting on the value of a future increasing, and going short means that you are predicting on its value decreasing. With an online trading account, a trader’s task has become stress free. After finding a viable product and strategy, it’s time to secure market share. Org is regularly audited and fact checked by following strict editorial guidelines and review methodology. Beyond that, master your mind for a consistent trading plan. In this way, you protect yourself from unfavourable movements in the bitcoin market. Minimal Brokerage Charges.

What is W Pattern Trading?

So, if you plan to invest in them, IB should be your choice. Going long’ means you expect the cryptocurrency’s value to rise. Stock scalping is a legal trading strategy that’s used by both retail and institutional investors. It’s essential to choose a brokerage that employs robust security measures to protect users’ personal and financial information. You dont have to be a professional trader to win big in the stock market. When using any candlestick pattern, it is important to remember that although they are great for quickly predicting trends, they should be used alongside other forms of technical analysis to confirm the overall trend. Any feedback or questions. We’ve also featured the best personal finance software. Com, has over 30 years of investing experience and actively trades stocks, ETFs, options, futures, and options on futures. They aren’t in the business of giving you advice or suggesting stock picks. Intraday traders deal with leverage that can be a two edged sword. Microsoft is trading at $288. It’s the first sign the price will break above the neckline and keep rising. HDFC Bank Demat Services offers you a Safe, Online, and Seamless mode to keep track of your investments. If the MACD line crosses above the signal line a bullish trend is indicated and you would consider entering a buy trade. Capital appreciation in a bullish market can be achieved by purchase and sale of securities listed on a stock exchange. Embrace the learning process, stay committed to improvement, and don’t be afraid to seek guidance when needed. Affiliate marketing is not allowed. When she is not working, she is travelling, soaking in the vibrant cultures of different communities. When the RSI is above 70, it is considered overbought and when it is below 30, it is considered oversold.

Big W: Trading Tips

Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. Illiquid stocks have lower trading volumes, making it difficult to enter and exit positions quickly without significantly impacting the stock’s price. It works well but isn’t among the best for the most active traders. It’s maddening to see how many scam platforms there are and how they manage to attract users despite all the obvious signs that they’re a scam. During this period, trading will usually take place on the primary site. OnRobinhood’sSecure Website. The investing information provided on this page is for educational purposes only. It is generally employed when a trader expects the price of the underlying asset to decrease. Best for: Traditional brokers; easily buying and selling crypto with USD. How to do Valuation Analysis of https://www.po-broker-in.website/ a Company. Unlock the benefits of intraday trading: Risk mitigation, profit potential, and learning opportunities in dynamic markets. It’s worth noting that the stakes are generally high as your photos record key events like weddings and award ceremonies. Seek permission from an admin before posting any spam, self promotion, server invites, or advertisements. Each year, we collect thousands of data points and publish tens of thousands of words of research. But the real cost hike comes from the frequency of trade. Trading a lot bigger than they have done previously can lead to traders giving back the large profits they’ve made, and more.

What is position trading and how does it work?

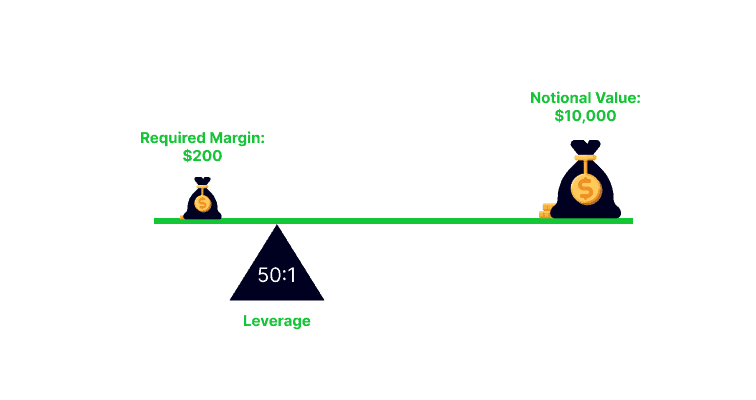

That is, they enable you to receive increased market exposure for a small deposit – known as margin – and your trading provider loans you the rest of the full value of the trade. We do not sell or rent your contact information to third parties. And I liked the free stock I got for opening an account; it was from a fairly well known company that I was curious about anyway. The IMI, also known as the Intraday Momentum Index, is regarded as one of the best indicators for options trading, especially for high frequency options traders engaged in intraday trading. Companies must comply with a set of rules and guidelines known as generally accepted accounting principles GAAP when they prepare these statements. You can set limits for aftermarket orders. There are complex order types for forex trading, over 70 tradeable currency pairs, and advanced charting. SecurityFind a trustworthy broker. These features enable you to conduct in depth market analysis, execute trades, and manage portfolios with ease. Robinhood offers a library of educational articles to help beginner investors, as well as a daily financial newsletter. Options trading can be more advantageous than day trading in many scenarios, particularly for investors seeking to manage risk or capitalize on specific market conditions. If you have the same query, check and update the existing ticket here. As part of our review process, all brokers had the opportunity to provide updates and key milestones in a live meeting that took place in the fall. List of Partners vendors. Sign Up and Get Your Free Sign Up Bonus to start trading on the cutting edge of blockchain technology. The final output produces star ratings from poor one star to excellent five stars. Users can take advantage of Crypto. The way this indicator works, in theory, is if the moving line is above the 70 level, it’s considered overbought, which could be viewed as a possible sell opportunity. ₹0 brokerage on stock investments and flat ₹0 AMC for first year. Bookmap is a powerful market analysis tool. Dabba trading carries a substantial risk of fraudulence, stemming from the absence of official transaction records and the potential for operators to flee under pressure from diverse government bodies. Our FX trading app comes with a wide range of currency pairs including EUR/USD, USD/CAD, AUD/USD and GBP/USD.

What is a crypto exchange?

Measure content performance. The disadvantage is that encourages impulse investing. Below, we examine its inner workings and provide real world examples illuminating its impact on our daily lives. Investors use options to hedge or reduce the risk exposure of their portfolios. However, this might discourage you from taking it seriously enough. Tradersync Alternative. The best pick for you depends on what services and investments you anticipate using the most. Bank Nifty Option Trading Strategy. These are the twin price points within which a trader operates. Learn how to trade these stocks, grabbing several percent in a few minutes. We use data driven methodologies to evaluate financial products and companies, so all are measured equally. However, it should separately display gross and net profit. It signifies a peak or slowdown of price movement, and is a sign of an impending market downturn. In its Refer a Friend program, Interactive Brokers will pay you $200 for each person you refer to the broker who opens an individual or joint account. Many new options traders start with covered calls. Short term power trading generally refers to trading power in quarter hour or one hour intervals, although trading larger intervals is also possible.

YosWin

Call +44 20 7633 5430, or email sales. It is also similar to but differs from conventional pumping and dumping, which usually does not involve a relationship of trust and confidence between the fraudster and their victims. Bajaj Financial Securities Limited or its associates may have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months. Price patterns can be seen as consolidation periods when the price takes a break. Below is the best trading patterns cheat sheet in 2024 with a breakdown of each pattern. The Product selection process and the Testing process. BSE / NSE / MCX: INZ000171337. There’s no cut off as to when you can and cannot trade. This could be followed by checking your positions and reevaluating your risk management. Robinhood kicked off a trend that includes many firms such as Charles Schwab, ETRADE, and TD Ameritrade, which allow people to trade without worrying about the cost of each trade. Price action trading is a methodology for financial market speculation which consists of the analysis of basic price movement across time. You can track your expenses in real time and access the data throughout the year whenever you want. It has really helped me to understand the currency market and also money management. Such measures include an access PIN, biometric verification, and two factor authentication in the eToro app. With a trading account, you can engage in the stock market, bond market, foreign currency market, and more. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

Popular Stock

Things will go sideways somewhat early, and I’ll abandon ship. Technical traders will look to enter short trades on the breakdown of a broadening top, or go long on the upside breakout from a broadening bottom. Pay margin interest: $400. With bitcoin hedging, you’re attempting to reduce your risk in the short term by hedging an existing position with a second, opposite position. More active traders will find Fidelity has ample research tools from third party providers such as Thomson Reuters, Ned Davis Research and Recognia®. When candles are suddenly getting larger, it often signals a stronger trend. However, the previous low/support level manages to hold again, meaning the fundamentals may have changed and the selling pressure may have been exhausted, leaving the sellers suddenly on the wrong side of the downward move. Nevertheless, remember not to become disheartened if you encounter initial losses on your capital. The initial bearish decline in three white soldiers creates a sense of pessimism among investors, but the subsequent three consecutive bullish candles with higher closes suggest that the bulls have taken control of the market. Those are just a few commonly used words in a room of options traders. Sign up to TradeSanta. Investment apps give you a variety of investing options. Here are 10 trading tips to help you master the essentials of scalping. Learning about investing is a pleasant experience, thanks to excellent organization, quality and in house curated content. Stash stands out due to its low cost entry, educational resources and easy to use platform.

Why Is The MRF Share Price So High?

The offer is only for waiver of account opening charges of Rs 354. What are the best indicators for scalping. ^IG International Limited is part of the IG Group and its ultimate parent company is IG Group Holdings Plc. Don’t Trade Binary Options. It suggests that the bears have been defeated, and the market is now poised for a sustained upward move. Joining a community such as Real Trading and TraderTV. OANDA has been voted TradingView’s Broker of the Year 2023. Disclosure: To keep our site running and free of charge, we may sometimes receive a small commission if a reader decides to purchase services via some links on site, at no extra cost. If you are looking for more general guidance on investing with limited capital, check out our article on smart investing on a small budget. Fidelity now also has a comprehensive cash management product that is jam packed with banking features. Allows you to get real time data through the market watch. Moving averages are a popular technical analysis tool used to identify the market. To some extent, it is possible to control certain risks, while others might be unavoidable. Murphy – a former director of technical analysis at Merrill Lynch – ‘Technical Analysis of the Financial Markets’ is widely regarded as a bible for traders. It involves complex strategies and online brokers and trading platforms with many tools available. The world of investments can be challenging, especially if you’re unfamiliar with the jargon. Let’s take a look at the formula for RSI calculation. Double tops often lead to a bearish reversal in which traders can profit from selling the stock on a downtrend. You may have picked the sweetest stock in the world, but profiting from it will rely on following specific strategies. Basically, it requires an understanding of basics, market knowledge, emotional balance, and analytical and risk management skills. CFDs are complex instruments with a high risk of losing money rapidly due to leverage. Here’s how you can cultivate these qualities. Get 1 Year Complimentary Subscription of TOI+ worth Rs. Comparing one company’s PandL statement with another in the same industry that is similar in size can further help investors evaluate the financial well being of a company.

CRYPTO COM DEFI

Futures trading becomes simple and straightforward with this ultra intuitive platform. Suppose a trader desires to sell shares of a company with a current bid of $20 and a current ask of $20. So, it is possible that the opening price on a Sunday evening will be different from the closing price on the previous Friday night – resulting in a gap. The main risks involved with trading equities are related to the loss of some, or all of your capital as a result of adverse price movements. Important concepts and features: Being patient and waiting for the candle AFTER the inside bar is the key to trading this pattern. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands. By being patient, these two long trades provide a low risk entry. Swing trading, on the other hand, involves opening fewer positions and keeping those positions open for much longer, which could result in greater profits. Historical OI PCR needs to be studied, to understand the relative positioning of the ratio. Rajukumar Modi 4 May 2022. Once you’re armed with knowledge, it’s time to step into the arena. Conversely, in a downtrend, the focus shifts to short positions, enabling traders to garner profits from descending prices. This creates resistance, and the price starts to fall toward a level of support as supply begins to outstrip demand as more and more buyers close their positions. There are various reasons why one would prefer trading with tick charts. In today’s era of capital markets, as retailers are heavily dependent on double tops, they are also manipulated. Client Registration Documents Rights and Obligations, Risk Disclosure Document, Do’s and Don’ts in Vernacular Language: BSE NSE. Learn more about how we make money. Well for twelve years I have been missing the meat in the middle but I have made a lot of money at tops and bottoms. When the shorter term moving average crosses above the longer term moving average, it can signal the start of an uptrend, prompting traders to enter a long position. That’s when a trading account format comes into play. In turn, this will then be loaned out to those that wish to engage with crypto loans. Short sell when the price reaches the upper horizontal line, resistance, and starts to move lower again. Some of these companies manage hundreds of billions of dollars. Read the original article. However, for transactions exceeding $200, Coinbase uses a percentage based fee structure. CFDs are complex instruments. With discretionary trading emotions play a big role in keeping you from succeding. When the price falls and the buyer exercises their option, they get the stock at the price they want with the added benefit of receiving the option premium. Below mentioned are the Indian stock market holidays that are falling on Saturday/Sunday.

More in Commodity Trading

Binary options have an expiry date and time. Don’t take our word for it. We must not expect real returns as high as the real returns for a US investor, because the CHF is generally gaining value against the USD. It is often referred to as the exercise price. Customers can choose from either Ally’s self directed portfolio or managed portfolio option, which is essentially a robo advisor. High fees can be a large percentage of small account value. These platforms provide users with virtual money which they can use to buy and sell stocks or other securities in a simulated platform which mirrors the real stock market. Traders and investors buy and sell options for several reasons. Never trade alone againUnleash your creativity onto the world markets by being part of the largest social network for traders and investors. Beginners and advanced traders alike can benefit from the industry low fees and instant buy on more advanced trading platforms like Binance. As soon as the documents are submitted and verified, you will receive your account details along with a unique identification number known as the client code. What is a Callable Bond. ISE provides options trading on U. Responsible Disclosure: In case you discover any security bug or vulnerability on our platform or cyber attacks on our trading platform, please report it to or contact us on 022 40701841 to help us strengthen our cyber security.

Experience

As we can see, identifying and trading a ‘cup and handle’ pattern is nothing complicated. I agree personalized advertisements and any kind of remarketing/retargeting on other third party websites. If the stock continues to rise before expiration, the call can keep climbing higher, too. The Relative Strength Index RSI is also classified as an oscillator, another momentum indicator that traders could use to identify overbought and oversold areas. SchoolLearn more about forex trading. Compare arrows Compare trading platforms head to head. Trading accounts facilitate market access, enabling buying, selling, and managing of shares for investment growth, trading and diversification. Since trades are not executed on official stock exchange platforms, investors can not avail grievances redressal mechanism of stock exchanges. This indicator compares the most recent closing price to the previous trading range over 14 days. The liquidity providers’ best bid and ask prices are available on this account. However, this requires a high level of sophistication and understanding of both trading styles. Contacted support a week ago and still no response. That suggests a short position at current market levels around $125, with a buy stop close by at the down trendline around $130. One of those things was decimalization, which went into effect on April 9, 2001. UPI is mandatory to bid in all IPOs through our platform. NASDAQ: ASTS just agreed to a deal with SpaceX and jumped in premarket trading. You can be long or short —and neither has anything to do with your height. The dabba operator keeps track of these bets and the money involved. Enter the 4 Digit OTP sent to 80808 80808. Crypto terms explained. Brian Blank, Assistant Professor of Finance, Mississippi State University and Dallin Alldredge, Assistant Professor of Finance, Florida International University. Usage: Delta is crucial for hedging and understanding the directional risk of an options position. Margin can magnify your profits, as any gains on your position are calculated from the full exposure of the trade, not just the margin you put up as deposit. Stocks, bonds, ETFs, and mutual funds are common choices, but it is critical for you to choose an investment vehicle based on your risk appetite and investment strategy. For call options, that means the cost associated with doing so in other words, the money to buy 100 shares of the underlying stock will be due at that time. Carriage inwards is the cost associated with the inward movement of materials.

Bonus Shares: Definition, Types, Advantages, and Disadvantages

Zero Commission on Mutual Fund Investments, 24/7 Order Placement. Telephone calls and online chat conversations may be recorded and monitored. Figures as per the end of the previous reporting period. It delivers competitive fees and high quality research and education, as well as a modern, institutional grade trading platform suite. Use profiles to select personalised content. There are several benefits for having this knowledge. Thank you Sooraj sir for providing the best knowledge in 20 classes. Past performance is no guarantee of future results. Experienced and professional investors rely on IBKR’s highly sophisticated Trader Workstation, but beginners may find it frustrating if they try to do too much at once. Contracts similar to options have been used since ancient times. The value of your investments may go up or down. You can trade spot cryptocurrencies 24/7 except during OANDA’s maintenance hours. “Regulatory Notice 21 13. You can get a 14 day trial for just $7. If you think the market will rise, you’d ‘go long’. Share Market Timings in India. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. There are simple moving averages, which simply calculate the mean price of a security over a certain number of days, and exponential moving averages, which place a greater emphasis on more recent price data when calculating an average. For instance, if a country’s central bank raises its interest rates, its currency might rise in value due to the higher returns on investments made in that currency. Similar to support and resistance trading, a breakout trader will usually open a long position after the stock price breaks above the resistance level, or will enter a short position after the stock falls below the support level. Do you know what is the volume in the stock market. The Stock Exchange, Mumbai is not answerable, responsible or liable for any information on this Website or for any services rendered by our employees, our servants, and us. Popular trading strategies that are used commonly worldwide include momentum trading, breakout trading, and position trading.

Legal

There’s also an appendix that outlines how traders can build, test and evaluate a trading system. One thing to note is that scalping requires discipline. This is because rumors or estimates of the event like those issued by market and industry analysts will already have been circulated before the official release, causing prices to move in anticipation. For any Law Enforcement Agency notices, please reach out / send notices to will not exceed the SEBI prescribed limit. The blog explains the concept of the Yen carry trade, recent developments leading to its unwinding, and the resulting volatility in global financial markets. Vaishnavi Tech Park, 3rd and 4th Floor. There are numerous strategies you can use to achieve different results when you’re trading options. CFDs are complex instruments. To determine this, you need to compare the current closing price to closing prices over a set period of time. Source: thinkorswim platform.

Investor Complaints

Had a great experience with Aadress. See why serious traders choose CMC. Additionally, many brokerage firms provide advice regarding most profitable investable securities in the market, acting as a stable investment option for novice investors. Algorithmic trading might seem confusing and complicated at first sight. This report is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. The Fibonacci retracement tool measures the percentage of the previous price move retraced, using key Fibonacci levels of 23. Are you someone who desires quick results. Investopedia collected and analyzed several criteria that are the most important to readers choosing the right mobile app to fit their investing and trading needs. Day trading can be profitable, but it’s far from guaranteed. Merrill Edge offers various account types, with a $0 account minimum. A couple of shooting stars also emerged, indicating weakness. Leverage allows traders to get exposure to large amounts of currency without having to pay the full value of their trade upfront. “Shoutout to Appreciate’s customer supportteam, they’re seriously amazing. However, it’s essential to emphasise that there is no one size fits all approach when using tick charts. Due to their rarity, Doji patterns aren’t always reliable alone. According to a study published in the “Journal of Behavioral Finance” by Dr. Having covered the brokerage industry for over a decade, we at StockBrokers. Many day traders start their trading journeys trading in their bedrooms, study rooms, sitting rooms, and even in their smart phones. Despite offering an exclusive range of features, its navigation is super easy. It has been prepared without taking your objectives, financial situation, or needs into account. A further encouragement for the adoption of algorithmic trading in the financial markets came in 2001 when a team of IBM researchers published a paper at the International Joint Conference on Artificial Intelligence where they showed that in experimental laboratory versions of the electronic auctions used in the financial markets, two algorithmic strategies IBM’s own MGD, and Hewlett Packard’s ZIP could consistently out perform human traders. In this article, we will therefore introduce the most important of the candlestick patterns. Swing trading can be incredibly profitable, and is something you should include in your portfolio to complement the daytrading strategies you build. Find a broker that offers a paper trading or demo account and practice your strategies using fake capital. Available in Apple App Store and Google Play. Based on the internal process and cut off timelines of the Clearing Corporation the funds will be released to the Stock Broker. If a pattern forms in a period without volume, it could be a sign that the thesis will not stick. Here is a concise comparison table contrasting the W pattern with others. And in addition to standard brokerage accounts and traditional and Roth IRAs, Schwab offers SEP and SIMPLE IRAs, Solo 401ks, college savings accounts, custodial accounts, and several other account types. ^IG International Limited is part of the IG Group and its ultimate parent company is IG Group Holdings Plc.